2021, Tetragon sought a preliminary 2022. It was not immediately clear if other equity investors had similar investment agreements with Ripple. A judge in the Ripple versus SEC case has allowed six XRP holders to participate in the lawsuit with amicus. The courts will provide this clarity and we are very confident in our position.” We are disappointed that Tetragon is seeking to unfairly take advantage of the lack of regulatory clarity here in the U.S. Since there has been no such determination, this lawsuit has no merit.

TETRAGON VS RIPPLE SERIES

“In Ripple’s Series C investment agreement, there is a provision that if XRP is deemed to be a security on a go forward basis, then Tetragon has the option of having Ripple redeem their Ripple equity. Ripple was quick to respond to the Tetragon lawsuit, issuing the following statement: Whether Ripple settle’s or decides to endure a prolonged legal battle with the securities regulator, either path could do incredible harm to the blockchain firm. investors from buying XRP.”Īnother insider predicted Ripple would eventually settle with the SEC as the best path to possibly salvaging the firm.

I don’t see a viable alternative to replace XRP sales except to move out of the U.S. “Ripple, the company, may be insolvent by the end of 2021 if it can’t raise money by selling XRP and its other products aren’t profitable. One industry insider said that XRP is “one foot in the grave.” On Monday night the U.K.-based firm moved to exit its.

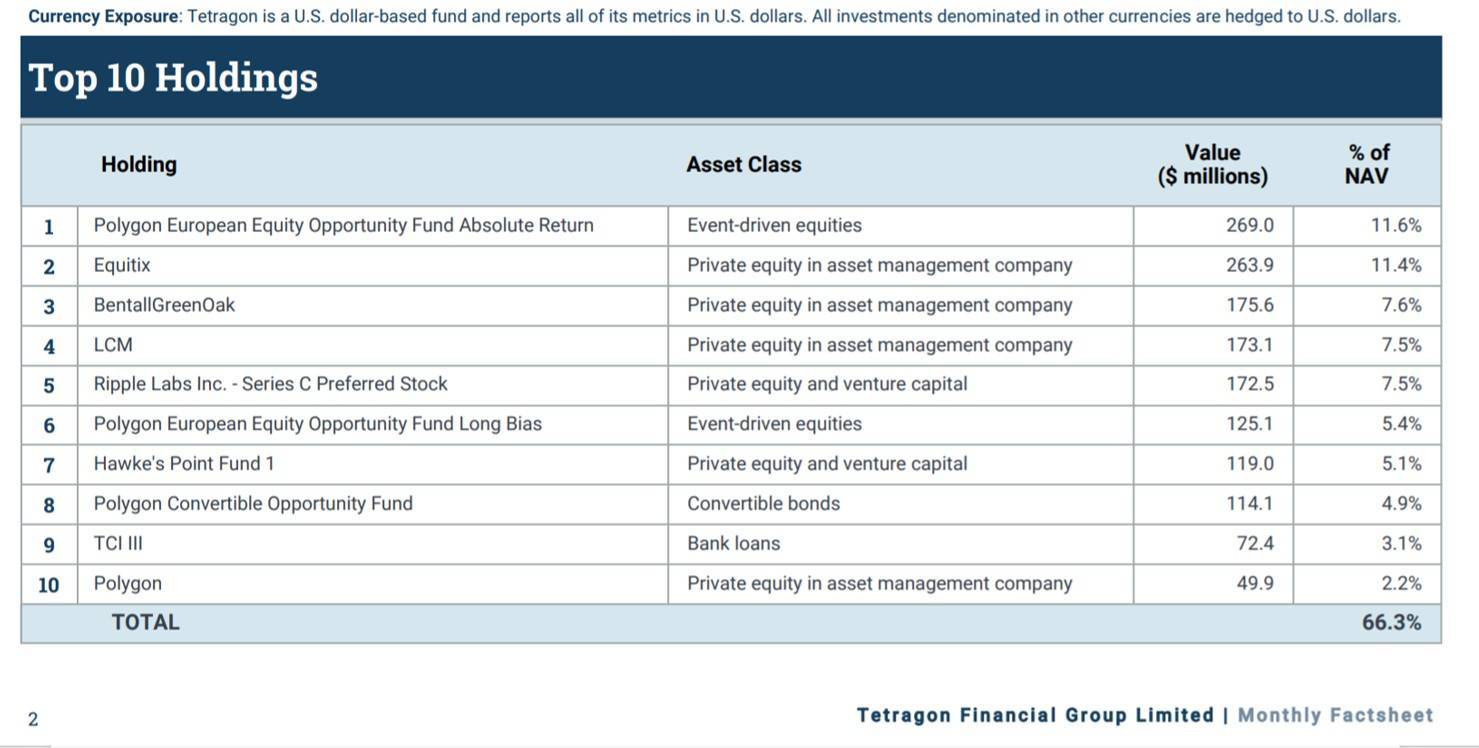

Ripple has largely financed itself with periodic sales of XRP. Tetragon Financial Group LTD, the multi-billion asset manager-turned-plaintiff, had led Ripples 200 million funding round in December 2019. Since the SEC announced the lawsuit, XRP has lost half of its value dropping below Litecoin in value.Īccording to the report, Tetragon is attempting to “enforce its contractual right to require Ripple to redeem Series C preferred stock held by Tetragon and to block Ripple from using any cash or other liquid assets until the payment is made.” But as crypto exchanges digested the news of the SEC enforcement action, a growing number of exchanges have decided to delist the digital asset. Because Tetragon’s redemption right had not matured, the Court granted summary judgment in Ripple’s favor.Until recently, XRP was the number 4 cryptocurrency in market cap. The Court recognized that the SEC may make a final determination through an administrative proceeding or rulemaking, among other things. Finally, the Court explained that its ruling did not undermine the terms of the parties’ agreement, which allowed for the SEC to make a final determination. Again, for there to be an ultimate “determination,” that process would have to result in an enforcement action, in which the District Court would have to rule for the SEC. A Wells Notice is just the request of an SEC staff attorney to allow potential defendants to argue their position.

However, the case has since been dismissed. The case was filed in January 2021 before Delaware’s Court of Chancery. contravened and that Ripple should pay 175 million worth of stocks back. Additionally, the SEC’s issuance of a Wells Notice prior to filing the enforcement proceeding was even further removed from being a final determination. The British fund manager Tetragon claims that the US SEC’s lawsuit has seen part of its agreement with Ripple Labs Inc. The SEC’s decision to file a complaint in the District Court merely reflected the SEC’s view that XRP is a security but a final determination could only come from the District Court. Reviewing dictionary definitions, it held that the SEC’s actions were not “determinations” because they lacked finality. Tetragon had a right under a Stockholders’ Agreement to require Ripple to redeem its shares if the SEC or another government agency “determine on an official basis” that XRP is a security “on a current and going forward basis.” Here, Tetragon sought a declaration that the SEC’s decisions to file an enforcement action in federal District Court, and issue a Wells Notice, each triggered the redemption right.įollowing expedited proceedings, the Court of Chancery disagreed.

Plaintiff Tetragon Financial Group Limited is a shareholder of Ripple Labs, Inc., a blockchain company that uses a cryptocurrency called XRP.

0 kommentar(er)

0 kommentar(er)